Task force leader highlights TIF law change

By Kevin O’Brien

A recent change in state law will significantly reduce the property tax hikes that occur due to growth inside TIF districts, according to the chairman of a Marathon County task force that’s studying the impact of tax-incremental financing (TIF) on county government.

Supervisor Dave Oberbeck provided the county board with an update on the task force’s work at the board’s Jan. 18 meeting, which included an overview of how TIF districts operate and how that has changed over time due to legislation in Madison.

TIF districts are designated areas within municipalities where the property taxes generated by any new buildings are used to pay for local infrastructure improvements and development incentives instead of being shared with the school district, county and technical schools. These different taxing jurisdictions agree to forfeit any additional tax revenue from these areas, usually for 20 or more years, in exchange for an expanded tax base in the future.

One of the biggest complaints about TIF districts is how they impact property tax levies for residents and businesses who do not directly benefit from TIF improvements.

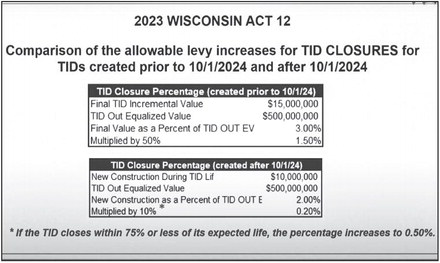

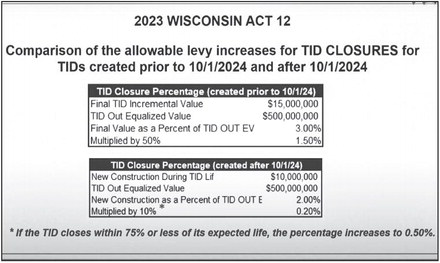

A new law, Wisconsin Act 12, will decrease the one-time tax levy increase allowed when future TIF districts terminate – from 50 percent of the final increment value down to 10 percent of new construction. That allowable tax hike will increase to 25 percent if the district closes with 75 percent or less of its lifespan left. This should incentivize municipalities to close their districts earlier, Oberbeck said. In addition, with new TIF districts created in 2024, municipalities can only count 90 percent of new growth in those new TIF districts when raising their tax levies from one year to the next. With TIF districts created before Oct. 1, 2024, municipalities can still factor in the full 100 percent of new construction in those districts when determining their annual tax increases.

Act 12 was celebrated by county and municipal officers last summer because it also boosted state aid by a total of about $275 million for all local units of government in Wisconsin. The sweeping law also exempted personal property from taxation and provided state compensation for that loss in revenue.

To the TIF task force, Act 12 is the latest example of how much state law has changed the nature of TIF districts since they were first enshrined into Wisconsin statute in 1975. The task force was created last year after it was noted that over $1 billion worth of property is currently exempt from traditional taxation across the county’s 40 active TIF districts.

Board chairman Kurt Gibbs said applying the county’s current mill rate of $3.99 per thousand of property value to the $1.4 billion in TIF districts equals about $5.6 million of “potential tax levy burden being shifted to the rest of the taxpayers.”

“It always used to be said that TIFs do not affect the tax rate. It’s free money or whatever,” Oberbeck said. “It’s not.”

Oberbeck said the task force’s goal is to bring policy recommendations to the board by March 31, with suggestions on how the county could possibly influence the creation and regulation of TIF districts, both on a local level and by petitioning state officials.

“There’s some definite things that we can do, and certainly some things we cannot,” he said.

Any time a city, village or town wants to create a new TIF district, a Joint Review Board is formed that includes one representative each from the county, school district and technical school and two from the municipality itself. Oberbeck said the county’s voice is “somewhat limited,” especially after the JRB votes to approve a new TIF district.

“The JRB doesn’t really have any power after they approve or deny that,” he said.

However, he said the county’s JRB representative should be asking extensive questions before a new TIF district is formed or amended. One of the most important questions is whether the proposed development in a municipality would have happened without TIF incentives – a criteria required by law – but that is difficult to determine, he said. Oberbeck said the county needs to develop some criteria for measuring the success of each individual TIF district and evaluating how much they are benefiting communities through new developments and more jobs. The overall objective, he said, is to “make them perform better, not get rid of them.”

TIF CHANGES - The infographic above shows the impacts of Wisconsin Act 12, which limits the amount that property taxes can increase due to growth in TIF districts. The top example shows how municipalities with existing TIF districts can raise their taxes more when a district closes because they can factor in 50 percent of the new development. For districts created after Oct. 1 of this year, however, the municipalities can only raise taxes using 10 percent of the new value.

David Oberbeck