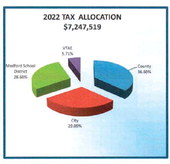

Falling tax rates

Tax rate plummets due to levy cuts, increases in property values

NEWS EDITOR

Taxes in the city of Medford will stay about the ...

Tax rate plummets due to levy cuts, increases in property values

NEWS EDITOR

Taxes in the city of Medford will stay about the ...