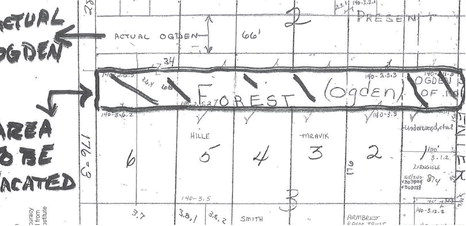

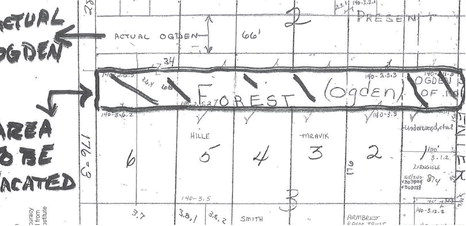

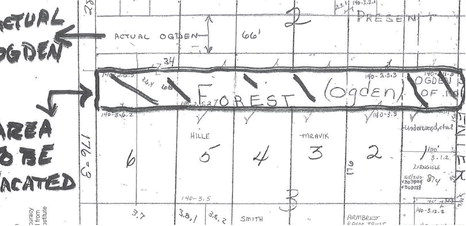

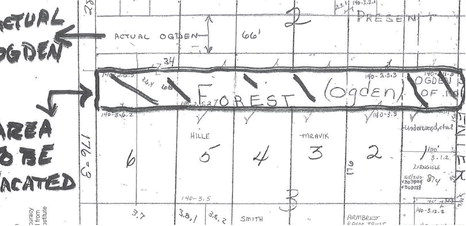

City starts process to eliminate a road in name only

Forest St. was planned to run next to Ogden St., but was never built

The city of Medford began the process of vacating Forest Street between Fou...

Forest St. was planned to run next to Ogden St., but was never built

The city of Medford began the process of vacating Forest Street between Fou...