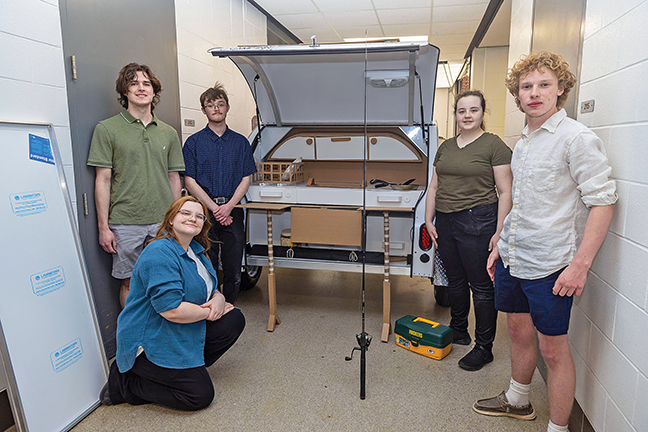

Manufacturers look forward to positive growth in 2025

Manufacturers expect to have a good 2025 even through the uncertainty facing the economy. They respect and acknowledge the complications in today’s economy and still have faith in their ability to m...