A tale of two TIDs

Economic growth on Marathon City’s north side continues to flourish, but the village is still struggling to redevelop its downtown area, according to information shared last Thursday about the village’s two tax-incremental financing districts (TIDs).

At an annual meeting of the village’s Joint Review Board – which includes representatives from the Marathon School District, Marathon County and Northcentral Technical College – village administrator Steve Cherek presented data showing very different performance levels for TIDs 1 and 2.

TID 1, which was established in 2002 to spur development primarily on the village’s north side, has seen nearly $46 million in new construction occur within its boundaries, including the Wagner Shell gas station and McDonald’s just south of STH 29 and several other businesses along Maratech Avenue. With a new industrial park having been established north of STH 29, Menzner Hardwood is planning to build a large production facility on land it purchased at a discount from the village.

At this point, only two village-owned lots remain vacant within TID 1, one of which is slated for a new Dollar General store, pending completion of a developer’s agreement. According to the village’s projections, TID 1 will pay off all of its debt and close with a $126,773 surplus in 2035, with over $54 million of equalized value being added to the tax roll the following year.

“I anticipate that $54 million to be a lot higher,” Cherek said, noting that other businesses are looking to expand or build before TID 1 closes. “That value is only going to increase.”

TID 2, on the other hand, is currently projected to end its lifespan with a small shortfall and will likely need to incur more costs in order to promote development on the village’s 400 block. Created in 2016 to support mixed-use development in Marathon’s downtown, TID 2 initially got a $6.4 million boost from an expansion at Marathon Cheese, but growth has since stagnated.

This last year, TID 2 saw a nearly $1.5 million decrease in its equalized value, mostly because the state exempted personal property, such as machinery inside Marathon Cheese, from property taxes. The state’s assessment value for manufacturing facilities also dropped. With TID 2 revenue falling short of infrastructure expenses, the village’s general fund and utility fund are currently advancing over $600,000 a year to the district.

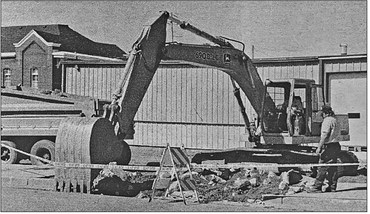

Village officials have been working for years to secure a developer for the 400 block, which has sat empty after the village borrowed money to demolish several vacant buildings within TID 2.

“Just because it’s gravel doesn’t mean it’s not active,” Cherek said. “We have the farmers market on there and it’s been kind of an attraction.”

TIDs are designated areas within municipalities where the property taxes generated by any developments are used to pay for infrastructure improvements and development incentives instead of being distributed to the local school district, county and tech schools. The Marathon County Board of Supervisors recently adopted a resolution calling for more scrutiny of TID proposals to make sure they are based on solid development plans and are closed within reasonable time periods.

At last Thursday’s meeting, Tom Vetter, the JRB’s citizen member, asked if any other industries have inquired about building in the new north industrial park. Cherek said Menzner’s bought up a large share of available village-owned land for their new facility, which promises to employ 125 people.

As a result, Cherek said any other businesses looking to build in that area will need to negotiate with private landowners.

“I’ve been getting asked by several businesses and I’ve been pointing out two private landowners, trying to see if we can arrange some kind of agreements with them,” he said.

One prominent development in that area, the new Kwik Trip on the corner of STH 107 and North Business Parkway, occurred just outside the TID 1 boundaries, so all of the taxes collected on that gas station and truck stop can already be collected by the school district, Marathon County and NTC. Still, without TID 1 paying for the new road and utility extensions, the store would not have been able to locate there, Cherek said.

“The TID helped create Kwik Trip,” he said. “So, that’s a $2.5 million expected tax assessment increase.”

Out of the $5.4 million in expenses originally budgeted for TID 1, about $880,000 in expenditures are still needed to complete the road and utility constructions for the north business park.

With TID 2, Cherek said the projected shortfall is a worst-case scenario with no new construction happening. As an alternative, he prepared a chart that includes a hypothetical $1.9 million worth of growth happening by 2028, followed by another $700,000 by 2030, which would result in the district closing with a $400,000 surplus by 2037.

“I’m working with developers,” he said. “I’m hoping that we can get some agreements in place really soon.”

Cherek said he believes the village many need to invest more money in its downtown in order to attract a developer for the 400 block and generate a positive balance for the district.

Vetter agreed that the village board will “need to spend money to make make money.”

“Overall, I think you’re on the right track,” he told Cherek.